Investing In Opportunity Zones: Tax Benefits And Considerations

The Investing in Opportunity Act: Its Genesis

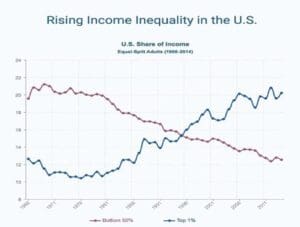

The Opportunity Zones initiative is a key program by the U.S. federal government that aims to spur economic growth and encourage investment in distressed communities. The rise of inequality in America, ascending since the 1970s and further fueled by the Great Recession, led to several place-based policies over the years. Place-based policies consider that locations that offer a concentrated pool of jobs and population are more efficient and productive. Past examples include the development during the depression of the Tennessee Valley Authority under the New Deal and empowerment zones established by President Bill Clinton in 1994. The Investing in Opportunity Act was passed as part of the Tax Cuts & Jobs Act of 2017 (Public Law No. 115-97) and enacted under the Tax Cuts and Jobs Act. President Donald Trump signed the bi-partisan act into law on December 22, 2017. This initiative offers attractive incentives for private investment in urban and rural low-income areas. Its primary goal is to drive economic expansion and create new job opportunities to stem the continued widening of inequality, now at the highest point since the 1920s. Roughly 1995, the top earners (the 1 percent) began to earn more than 20 percent of the income, while the bottom half of earners controlled less than 11 percent of income. This is a mirror image of the 1970s trend, as illustrated in the graph below.

Courtesy of OpportunityDb

Tax Benefits For Multifamily Investors

This advantageous tax incentive program has become a favorite among commercial real estate investors, particularly multifamily investors. With this program, an individual who faces capital gains due to the sale of an asset can leverage the tax benefits associated with placing their investment in a Qualified Opportunity Zone Fund, provided that the investment occurs within 180 days from the capital gains occurrence.

Opportunity Zones have provided an opportunity to a different class of investors. Through this innovative initiative, individual investors and family offices can now participate in the same multifamily opportunities accessible only to institutional investors.

It’s worth noting that parts of this program are scheduled to expire in the next few years. The program is complex, and there are some gray areas. For guidance, consult your tax professional to learn about the potential risks and advantages. Information on the program can be found on the IRS.gov website at The Internal Revenue Code Section 1400Z or the Opportunity Zones tax incentive.

The Blueprint

Opportunity Zones offer favorable capital gains treatment for taxpayers with unrealized gains who invest in designated low-income communities through specialized Opportunity Zone Funds comprised of a partnership or a corporation that intends to invest a majority of its holdings in one or more of the 8,700 qualified Opportunity Zones, remain effective through the end of 2028.

By investing in a Qualified Opportunity Zone Fund, individuals can take advantage of three different tax incentives that exist:

- Deferral of capital gains invested (set to expire December 31, 2026),

- Reduction of capital gains invested through a step-up program leading to a 15% reduction in capital gains tax and,

- Exclusion of gain on qualified opportunity zone property held for at least ten years.

Regarding real estate, Opportunity Zone Funds are restricted to building new construction or substantial existing property improvement. Multifamily is the primary CRE sector positioned to gain the most from this program, stemming from its function to provide housing.

Market Fundamentals Apply

Investors are advised not to be incentivized by this program's attractive tax benefits alone. Market fundamentals should still apply, and benchmarking a potential project against your criteria should guide your investment thesis—just as with any other multifamily investment opportunity. Focusing on regions with solid job and demographic growth and analyzing existing barriers to entry is key to making a wise investment decision. Real estate remains one of the best alternative assets, offering upside to protect against inflation and create steady income. ApartmentBuildings.com gives investors control over their investment portfolio, helping to identify properties by region and type and connecting you with helpful professionals to build a well-diversified portfolio.

Other Investing Classroom Articles

Digital Marketing Strategies for Multifamily Properties Webinar and Learning Resources

Digital Marketing Strategies To Get Results Leverage the latest tools and tech to stand apart Sofia Guzman, Head of Marketing at SharpLaunch, recently sat down with Connect CRE and ApartmentBuildings.com’s CEO, Daniel Ceniceros, for SharpLaunch’s monthly webinar series. They delved into digital marketing strategies for multifamily properties to attain maximum exposure and traction. Their in-depth...

Learn more

Connect Classroom Online CRE Professional Development: 5 Top Courses For Multifamily

Delivering a unique educational experience that provides essential sustainability skills needed by commercial real estate professionals. Maintain Your Competitive Edge Commercial real estate transactions can be specialized and complex, so it’s crucial that you equip yourself and your team with the skills needed to stay ahead of the ever-changing industry topics, compliance, and regulatory challenges....

Learn more

The Bottom Line On Affordable Housing: A Positive Investment For Good

Affordable Housing offers a way for property investors to earn consistent rental income and help improve their underserved communities. There is also potential upside when selling the asset, and it offers a way for new investors to enter commercial real estate. The old view that affordable housing is a riskier and inferior asset class is...

Learn moreBrokers

View All-

Ben Galles

CBRE | Nevada

-

Filip Niculete

Marcus & Millichap

-

James Nelson

Avison Young - US - NY - New York

-

Ken Wellar

GREA

Lenders

View All-

Felix Gutnikov

California

-

Gary Bechtel

North Carolina

-

Brad Ross

California

-

David Christensen